What could Trump’s election victory mean for Latin America?

Leer en Español

Tougher trade policy: Trump has floated the idea of a 10.0–20.0% baseline tariff on all imports. If realized, this would thump the more U.S.-dependent Latin American economies—particularly Mexico and Central America. In addition, Trump is likely to attempt to renegotiate the USMCA trade agreement when it comes up for review in 2026. This could leave Mexico—one of the three signatories to the deal along with Canada and the U.S.—worse off. Mexico’s economy is intertwined with that of its northern neighbor: The U.S. is the destination of around 80% of Mexico’s exports and provides it with more than half of all imports. Finally, Latin America enjoys a large goods trade surplus with the U.S, a particular bugbear of Trump’s which could put the region in his crosshairs once elected.

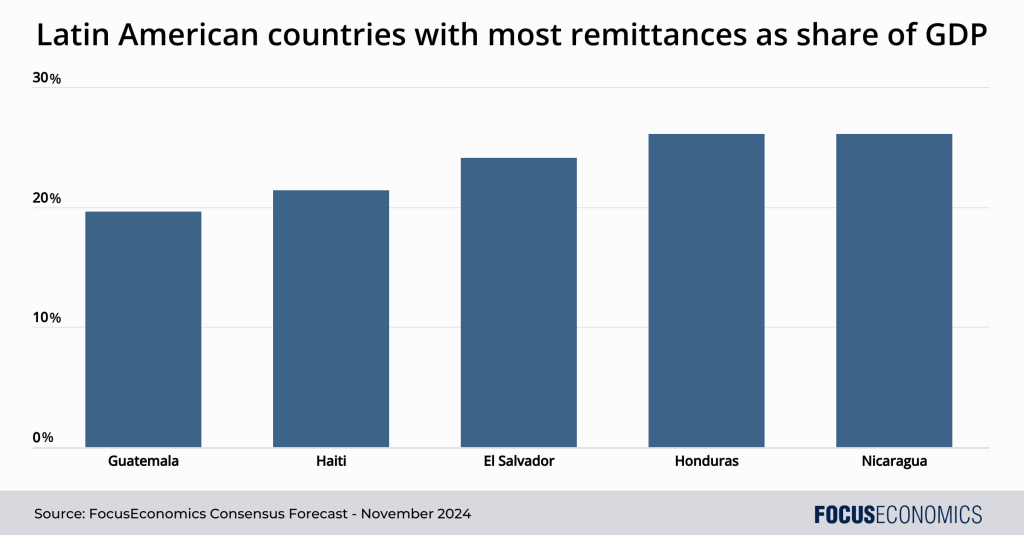

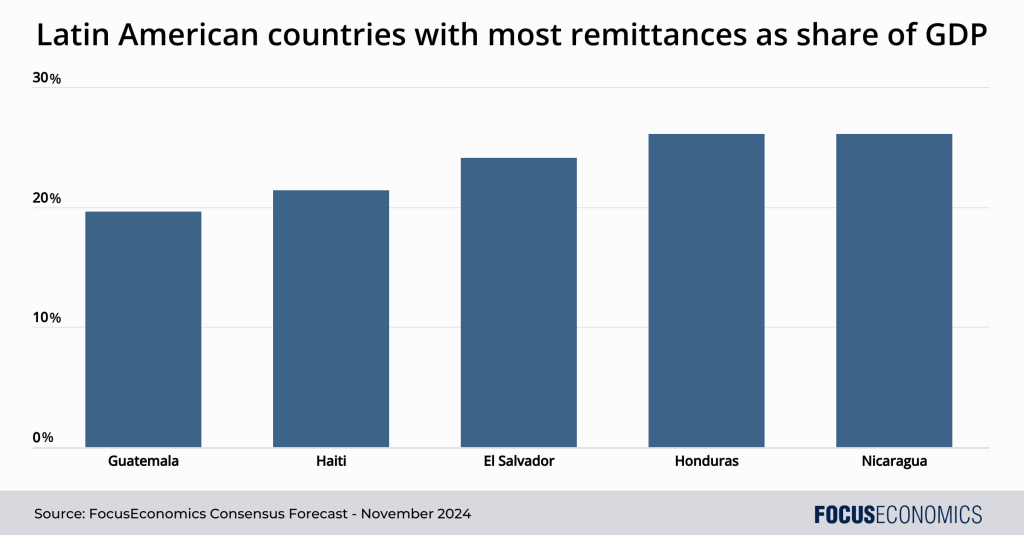

Remittances to suffer: Remittances are a critical income source for the region—particularly in Central American countries, where they are often worth over 20% of GDP. The vast majority of these remittances stem from migrants working in the U.S. With policy towards both legal and illegal immigrants set to tighten under Trump, remittance flows to the region are likely to take a hit, weighing on the incomes of Latin American households. If—as is possible, albeit less likely—Trump follows through with his threats of mass deportations, this could strain social systems in the Latin American countries that end up housing the deportees; on the flipside, deportations could boost government and private spending in recipient countries.

Commodity shake-up: Trump has promised to “drill, baby, drill”. U.S. hydrocarbon production—which is already at a record high—is likely to increase further under his term as he loosens restrictions on oil and gas. This could reduce U.S. demand for imported oil, affecting exporters like Brazil, Ecuador, Mexico and Venezuela. At the same time, Trump is likely to cut government support for clean energy technology, taming demand for metals that play an important role in the green transition—cobalt, copper, lithium and zinc to name but a few. Latin America has many of these metals in abundance; potentially lower demand and prices for these metals under Trump bodes poorly for the region’s exports and fiscal revenue.

U.S.-China relations: If Trump jacks up tariffs on Chinese imports as he’s threatened to do, this could have multiple effects on Latin America. It could lead to greater re-export trade via Latin America—particularly through Mexico—in order to circumvent tariffs. It could also encourage more firms to invest in manufacturing facilities on the continent as opposed to in China. But U.S. tariffs on China could also weaken the Asian giant’s economy, and therefore its appetite for Latin American raw materials, hitting the region’s exports.

The bottom line: Whichever way one looks at it, Trump’s second term spells turbulent times for a region which is already suffering from the ills of political polarization, social instability, crime, corruption and gaping inequality.

Insight from our analysts:

On Mexico, EIU analysts commented:

“We expect that Mr Trump would fixate on the US’s widening trade deficit with Mexico, as well as on Mexico’s growing trade and investment links with China. Tariff threats would be a common feature of Mr Trump’s Mexico policy, although we believe that these would serve more as negotiation tools, rather than as signals of actual policy intentions. Mr Trump would focus on curbing illegal immigration to the US, including via tighter border restrictions, and would pressure Mexico to play a larger role. He would also target drug cartels operating in Mexico, although he would be unlikely to carry out threats of unilateral US action on Mexican soil.”

On immigration, Goldman Sachs analysts said:

“We expect a second Trump administration would reduce immigration to a level similar to the first Trump administration. Control of Congress could also influence the resources available to enforce existing immigration policies. For this reason, we assume that net immigration slows to 750k/year—slightly below the 2017-2019 rate—in a Republican sweep [of both houses of Congress].”

Our latest analysis

- The U.S. economy remained in rude health in Q3.

- Mexico’s economy performed better than expected in Q3.

The post What could Trump’s election victory mean for Latin America? appeared first on FocusEconomics.

Leave a Comment